Scroll to:

Smart contract disputes and public policy in the ASEAN+6 region

https://doi.org/10.38044/2686-9136-2022-3-4-32-70

Abstract

Smart contracts provide some benefits, such as better facilitation for contracting parties to monitor performance of their obligation and reducing the cost spent monitoring the contract. However, it is critical to understand various limitations of this concept as well as many legal and public policy uncertainties around it. Given the non-existence of an “universal rule” that governs smart contracts, the issues vary from jurisdiction to jurisdiction. The article applies comparative legal method to analyse the legal regulation of smart contracts in ASEAN+6 countries as well as the leading jurisdictions in the sphere of implementing digital technologies in the economy. Due to public policy considerations, there are different scenarios of smart contract development. The possible outlook is that ASEAN+6 countries would not accept smart contract as contract, cryptocurrency as property, and/or enforcing foreign awards that relate to smart contract disputes and/or cryptocurrency. Another possible way out of the deadlock is to govern relations under smart contracts by the UNIDROIT Principles. However, if the parties do not opt for such a solution, the determination of the applicable law will be left to the relevant conflict-of-laws rules with all of the uncertainties. Therefore, the author suggests that supranational laws is the better path for avoiding uncertainties in smart-contractual relationships.

Keywords

A new technology called “smart contracts” has emerged. What makes these legal agreements innovative is that their execution is made automatic through the use of computers.

Max Raskin1

INTRODUCTION

In this day and age, smart contracts have provided some benefits, such as better facilitation for contracting parties to monitor the each other’s performance inside the contract, verifying if and when a contract, or one of its conditions, has been completed, guaranteeing that only the details necessary for completion of the contract are revealed to both parties, saving time through self-enforcement, and reducing the cost spent policing the contract, among others (Szabo, 1996).

This has, no doubt, provided speed and efficiency in the business context, as smart contracts essentially do not rely on human intervention, and their implementation is guided and overseen by other basic units of data structure (i.e., nodes) in the blockchain network. Hence, once the contract is triggered, the scripted contract self-executes (Nzuva, 2019).

Despite the various benefits of implementing smart contracts already noted, it is also critical to be aware that smart contracts are associated with various limitations, and there is much legal and public policy uncertainty surrounding smart contracts that has led to disputes. Some of these limitations and uncertainties are: (a) technology often outpacing the law and regulatory framework (Kõlvart et.al., 2016), (b) immutability, (c) contractual secrecy, (d) security, (e) enforceability of smart contracts under contract law, (f) governing legal and jurisdiction issues, (g) the legal value of blockchain-based proof, (h) blockchain creation of assets, (i) decentralized autonomous organizations (DAOs), and (j) blockchain transfers of value.

The legal uncertainties related to smart contracts are:

(a) whether a smart contract is legally binding;

(b) unexpected performance issues caused by coding errors;

(c) broader problems of enforceability;

(d) uncertainty over legal jurisdiction and governing law;

(e) formation;

(f) modification;

(g) public policy considerations.

Given the non-existence of a ‘universal rule’ that governs smart contracts, the uncertainty raised above varies from jurisdiction to jurisdiction and will be discussed in detail.

Taking into account the legal uncertainty surrounding smart contracts, how will countries’ courts apply public policy considerations when being asked to set aside an award (at the seat) or refuse to grant recognition and enforcement? On the one hand, it is well accepted that public policy is meant to be construed narrowly. However, Article V (2b) of the New York Convention provides that: “recognition and enforcement of an arbitral award may also be refused if the competent authority in the country where recognition and enforcement is sought finds that the recognition or enforcement of the award would be contrary to the public policy of that country”,2 where it is referring to national public policy in the sense that it is either at the court at the seat that a party is seeking to set aside an award, or the court in the territory of enforcement if a party is seeking to challenge enforcement. One example where public policy is interpreted widely is the case of Ruling Yue 03 Min Te No 719 (26 April 2020) (“the Shenzhen case”).3

Another example would be the Indonesian court’s adoption of a wider position in the case of Bankers Trust v PT Mayora Indah Tbk (2000)4 and Astro Nusantara Bvetal v PT Ayunda Primamitra (2010),5 which caused problems in enforceability and recognition of foreign awards. However, in recent years, Indonesia had adopted a mixed approach to cryptocurrencies such as Bitcoin, Ethereum, Dash Litecoin, and Ripple under the Commodity Futures Trading Regulatory Agency (known as Bappedti). So, is this good news with respect to the recognition of smart contracts and virtual assets?

Undoubtedly, most courts in arbitration friendly jurisdictions will adopt a narrow interpretation of public policy. Jurisdictions like Singapore, Malaysia, and in recent years India, have adopted a narrow interpretation of public policy. The high standard required to set aside an award on grounds of public policy in the case of BVU v BVX [2019] SGHC 696 is one example. So, should national public policy considerations be construed as and confined to those matters that are found to breach natural justice, fairness, and equality? In this dissertation, we will extensively explore the positions of various countries in interpreting public policy, particularly, Singapore, Hong Kong, Malaysia, Indonesia, India, and China.

Is there something about smart contracts that is going to cause a problem there? It might in some nations. What if a country doesn’t recognise a smart contract as being a proper contract or takes the view that smart contracts do not adhere to the traditional principles of contract law. Then, it is going to say that public policy is an issue. And what about courts in jurisdictions that do not accept that virtual assets like cryptocurrency are property?

Therefore, should parties have smart contracts governed not by a specific country’s laws, but by supranational law, or even by soft law principles, such as the UNIDROIT Principles of International Commercial Contracts? Whatever the choice, it incumbent on parties and the tribunal to understand where enforcement is likely.

In the end, the courts are going to face inherent conflicts, as there is a demand for a narrow interpretation for public policy, but at the same time, national laws in some countries have not taken into account smart contracts or the approach they take to cryptocurrency as virtual assets. Therefore, at the moment, one way forward might be for parties to say they do not want the law governing a particular contract to be tied to any particular jurisdiction, and, instead, have the option of choosing supranational law or UNIDROIT Principles to govern the contract.

Another possibility that would give parties room to manoeuvre is the adoption of a form of Ricardian contract, where the parties can have an encoded version, as well as a natural language version. This could help in countries that are less inclined to accept smart contracts as proper contracts. Therefore, this research will be generally relevant to legal practice, as smart contracts are likely to be used for AI concluded contracts, as well as those involving virtual assets.

WHY THERE COULD BE CONFLICTS BETWEEN RESOLVING SMART CONTRACT DISPUTES AND APPLYING PUBLIC POLICY IN THE ASEAN+6

In light of the ongoing debate as to the use of smart contract technologies to enhance the way business is conducted, public policy considerations surrounding such usage, and the challenges regarding the widespread adoption of smart contracts, it is important to understand how smart contracts can be used to do more than just improve the way business is conducted.

As observed by computer scientist and cryptographer Nick Szabo (1996), because of the existence of smart contracts, “new institutions, and new ways to formalize the relationships that make up these institutions, are now made possible by the digital revolution. He called these new contracts ‘smart’ because they are far more functional than their inanimate paper-based ancestors. No use of artificial intelligence is implied. A smart contract is a set of promises specified in digital form, including protocols within which the parties perform these promises.”

Ideal as it sounds, based on Nick Szabo’s observation, “innovative technology does not necessitate innovative jurisprudence, and traditional legal analysis can help craft simple rules as a framework for this complex phenomenon.”7 Therefore, there must be opportunities to develop sustainable laws and public policy for smart contracting. With respect to legal and public policy issues surrounding smart contracting, this may be limited by the regularity of cases in different jurisdictions and individual territorial public policy considerations emerging in the ASEAN+6 region. Hence, for the use of the smart contract to be further advanced, there is a need to reconcile the legal and public policy considerations surrounding it.

It is arguably true that legal principles and public policy are, indeed, an important part of the recognition and the enforceability of smart contracts. However, it is possible to find room for improvement in these areas by examining ways in which laws and public policy are developed in the ASEAN+6 region, given that, in practice, smart contracts are playing a more important and pivotal role in facilitating the exchange of nearly all goods and services in various industries.

Businesses across the globe, as well as researchers and practitioners, widely recognize the benefits of smart contracts’ unique features with regard to automatic execution, transparency, and immutability in a blockchain environment.

Although it must also be acknowledged that there are natural language and coding issues, this research will focus on, explore, discuss, and contribute to issues related to the following main areas:

(a) The application of traditional principles of contract law to smart contracts

(b) Current Public Policy trends with respect to awarding cryptocurrency in an arbitration award

(c) Case law on the enforcement of smart contracts and/or enforcement against virtual assets (i.e., cryptocurrencies)

(d) Jurisdictional issues and challenges in terms of public policy and law, particularly in the ASEAN+6 region.

(e) The relevance of resolving smart contract disputes to legal practice and the real world.

(f) Concluding Observations.

It is arguably true that there are ongoing difficulties in many areas such as (a) broader problems in enforceability, (b) uncertainty over jurisdiction and governing law, (c) formation, (d) modification, and (e) public policy considerations. It is also worth mentioning that governments have an important role to play to harmonize standards within the ASEAN+6 region with regards to the reconciliation of smart contract disputes and public policy considerations.

There may be issues in getting the courts to assist in producing or preserving evidence and/or freezing of assets, as some courts may not recognize smart contracts as contracts. Apart from the recognition and enforceability of smart contracts, even when a party is successful in securing an award, court order, or interim measure, there might be issues with respect to the arbitrability and/or enforceability of the court judgment.

CAN ONE APPLY TRADITIONAL PRINCIPLES OF CONTRACT LAW TO SMART CONTRACTS?

Determining the legal definition of a ‘smart contract’ has, indeed, been one of the most controversial issues. Some distinguish between smart contracts, smart contract code, and smart legal contracts (Blemus, 2018).8 However, it has been posited that any evaluation of their legal status must be guided by the law applying to the underlying contract (Kaulartz & Heckmann, 2016; Spindler & Woebbeking, 2019).

In a legal sense, just as traditional contracts are encoded, the law applicable to smart contracts is decided according to general principles, which means that the question of whether a legal contract has been concluded is dependent on the applicable legal provisions, which may, for example, require certain formalities that may lead to differing assessments of smart contracts in different jurisdictions (Reusch & Weidner, 2018).

In order to determine whether a smart contract can give rise to a legally enforceable contract, consideration must be given to whether each of the requirements necessary for a legally binding contract is met. It should be noted that the initial stage of concluding a contractual agreement does not significantly differ between smart and traditional contracts because, before a smart contract is activated, the parties must agree to a set of terms that initiate the program.9

Unlike traditional contracts, in the world of smart contracts, acceptance comes through performance. One can say they will initiate a smart contract, but there is no smart contract until they do. A smart contract can be posted to a ledger as an offer, but the contract is not formed until some action is taken to initiate acceptance, such as transferring a certain sum of money to the code.

Just as there is bargained-for consideration in traditional contracts, there is consideration in smart contracts.10 The courts believe that mutuality of obligation distinguishes a contract from a gift for which parties do not have the same rights of legal enforcement. That is one of the reasons for having the doctrine of consideration.

A component of contractual law regulates issues where the parties, as a matter of law, cannot vary in their contracts from the mandatory provision laid down by contract law. Certain legal principles, like offer, acceptance, consideration, intention to create a legal relationship, contractual intention, certainty, and completeness, are so fundamental to the regulation of economic activity that courts will not enforce otherwise valid contracts if these principles are not complied with. There are also limitations on the freedom of smart contracts.

It was mentioned earlier that smart contracts are considered ‘smart’, as they are self-executing. And of course, depending on the type of execution, they are divided into two categories. In the first category are those whose precise execution is known at the time of creation and, in the second, are those smart contracts whose execution is linked to a certain but unknown event or condition that cannot be encoded at the moment of creation.

It is important to note that blockchain and the smart contracts stored on them are immutable (i.e., practicably impossible to change), as the code is distributed on the blockchain across a network and would require sufficient consensus of the network to alter. Hence, once a smart contract is executed, its execution cannot be reversed even though a new transaction could be made by the parties to effectively nullify the result of the execution.

Smart contracts are undeniably widely used commercially. However, in the case of code-only smart contracts, the code that is executed and the outcome it produces represent the only objective evidence of the terms agreed upon by the parties. This is in contrast to cases with traditional text-based contracts, where courts will examine the final written document that the parties have agreed to in order to determine whether the parties are in compliance or breach. With code-only smart contract cases, email exchanges between the parties discussing what functions the smart contract should execute, or oral discussions to this effect, would likely yield to the definitive lines of code as the determinative manifestation of the parties’ intent, as courts have long emphasized that it is this final agreement that represents the mutual intent of the parties (i.e.,consensus ad idem, which is known as “the meeting of minds”).11

Given the above considerations, the question to ask would be, “Is a ‘smart’ contract a real contract?” For obvious reasons, in order for a ‘smart’ contract to be a real contract, it must fulfil all of the requirements for contractual formation discussed above.

It has been proposed that the initial stage of a contractual agreement is similar for smart contracts and conventional contracts because, before any contract-ware can operate, two parties must agree to some set of contractual terms (Raskin, 2017). Therefore, it is a relief to know that the rules pertaining to offer and acceptance will not, in essence, pose an obstacle to the recognition of smart contracts as legally binding, as offer and acceptance, as well as the conduct of the parties, are evaluated objectively.12 Furthermore, when parties submit their private cryptographic keys to commit resources to a blockchain-based smart contract, that is proof of a commitment (Werbach & Cornell, 2017).

When an offeror posts a smart contract on the blockchain in binary computer code clearly stipulating the terms of the transaction, it will be held to constitute an offer as opposed to an invitation to treat.13 And once the proposed smart contract is posted on the blockchain and has fulfilled the requirements of being an offer in terms of identification of the essentialia negotii of the contract, it is effectively an acceptance by the offeree, and acceptance can be fulfilled through conduct.

For example, the offeror can write a smart contract stating that, for 30 Ethereum, the offeror will transfer ownership of a bicycle, including the terms of the deal, and upload it to a blockchain along with a digital token representing the bicycle and gas, which is payment for uploading the contract. Hence, this constitutes an offer. Subsequently, an offeree who is willing to accept will upload the 30 Ethereum to the smart contract, which constitutes acceptance. The smart contract will then detect the upload of 30 Ethereum and automatically transfer it to the offeror’s wallet, while, at the same time, transferring the token to the offeree who uploaded the 30 Ethereum. The offeror does not need to confirm that he received the 30 Ethereum, and the token for the bicycle is transferred without further verification or discretion of the offeror. Therefore, the acceptance can occur either by performance or by the authorization of transfer by putting in the special cryptographic key (i.e., password) (Jaccard, 2017; Szczerbowski, 2017).

Performance of the terms in a unilateral contact or a signature by inputting the personal cryptographic key can be a clear act of acceptance. Therefore, the rules on offer and acceptance will not pose fundamental problems for the formation of smart contracts, as the procedure for forming such agreements are in accord with the elements of offer and acceptance.14

A point to note about contract law’s approach to ‘automatic contracts’ is that a contract is formed when coins are inserted into a machine, in the case of Thornton v Shoe Lane Parking (similarly to Szabo’s vending machine analogy), and the fact that the subsequent process occurs without human intervention does not preclude the formation of a contract.15 This is reinforced by the R (Software Solutions Partners Ltd) v HM Customs & Excise case, where it was held that an “automatic medium for contract formation” can result in valid contracts.16

In most common legal jurisdictions, the existence of valid consideration represents a mandatory condition for any contract to be legally enforced. For a consideration to be valid, it must only be sufficient,17 and not adequate. Hence, the value and equality of mutual exchange is legally irrelevant from the perspective of contract law formation. Therefore, it is arguably true that the consideration requirement can easily be satisfied in the case of smart contracts, as smart contracts entail an exchange of digital assets, as in the example provided above describing the sale of a bicycle for 30 Ethereum.

However, an interesting argument has been raised by Webach and Cornell, who pointed out that smart contracts do not contain an exchange of promises, as is usually the case in normal contracts, or a requirement for a valid consideration. Both Webach and Cornell observed that “If someone balances a pail of water on top of a door, he does not promise to drop water on whoever next opens the door. Rather, he has merely set up the mechanical process by which that will happen. In a similar way, a contract to transfer one Bitcoin upon such-and-such event occurring is not really a promise at all. It does not say ‘I will pay you one Bitcoin if such-and-such happens’, but rather something like ‘You will be paid one Bitcoin if such-and-such happens’... the so-called ‘[smart] contract’ is not an exchange of promises or commitments. Creation of a smart contract — while setting certain events in motion — does not commit any party do no anything. There’s nothing being prospectively promised” (Werbach & Cornell, 2017).

While this observation is surely a departure from the realm of traditional contracts. that issue did prevent the authors from reaching the conclusion that smart contracts are nonetheless legally valid contracts. Another author (Savelyev, 2017) has raised an additional question as to whether a smart contract is really a contract, given that it does not contain any obligation. He concluded that it is probably more correct to say that the main consequence of the conclusion of a smart contract is not the appearance of ‘obligations’, but the result of a self-limitation of certain rights by technical means.

Furthermore, Werbach and Cornell also argued that, though such commitments might not constitute promises per se, smart contracts are indeed agreements that purport to alter the parties’ rights and obligations, and that an agreement may still be considered a contract even if it leaves nothing to be done or performed. Therefore, if one argues that smart contracts do not constitute a ‘promise’, but more of a guarantee, and, thus, cannot be recognized as a real contract, this is an unrealistically ideal view of contract law. Some considerations, such as benefits, rights or detriment, loss or responsibility etc., will be conveyed under smart contracts, inducing a reciprocal promise, and, pragmatically, there will almost always be sufficient consideration (Werbach & Cornell, 2017).

Intention to create legal relations in a commercial relationship is presumed in common law, and this presumption must be disproved by a party claiming that there is no such intention. It could be argued that, for every smart contract entered into in a commercial setting, the intention to create a legal relationship will be presumed.18 Another more nuanced view offered by Savelyev (2017) is that, by concluding a smart contract, the contracting parties have demonstrated the intention to use an alternative regulatory system instead of traditional contract law.

Therefore, he observed, there might not be a true intent to create a legal relationship. However, the author also admits that, if the result is factually the same in substance to the one regulated by ‘traditional contracts’, it can be argued that the nature of the relationship is the same.

Most common law lawyers know that, for a contract to be enforceable, parties need to have the capacity to enter into such contract. However, most of the other existing blockchain platforms, in fact, do not check for full legal capacity (e.g., Ethereum). Instead, in principle, anyone can open an account without having sufficient capacity to do so. As there are no means by which smart contracts can test for capacity, they can be entered into by minors, drunks, or any other incapacitated person. Hence, people lacking capacity to sign a contract in the real world could potentially do so on the blockchain platform.

On the other hand, if there was no capacity, the party could then legally invalidate the transfer of any asset ex post by filing a lawsuit claiming unjust enrichment or, technically, through a reverse transaction (Schrey & Thalhofer, 2017).19 However, this may not be an ideal alternative because there are pseudonymous users with cryptographic strings of random letters and numbers. Hence, it may be difficult to identify who to sue. Additionally, a reverse transaction can only factually rewind the contract, but not legally void the transaction, as it may remain on the blockchain since the blocks are immutable (Schrey & Thalhofer, 2017).

The above notwithstanding, the fundamental point remains that if a person possesses legal capacity, they will be free to enter into legally binding smart contracts. Last but not least, the contracting parties to a smart contract are technically not even people but only private cryptographic keys which represent individual people (Werbach & Cornell, 2017). Therefore, the question arises as to whether the issue of capacity can even be discussed since the parties are technically not human. It has been proposed that this is not a consideration for autonomous contracts, as the private keys do not act by themselves, but are instructed by humans.

Therefore, it is possible to believe that, by virtue of their flexibility, adaptability, and process of formation, smart contracts can be considered legally valid contracts, at least according to English contract law. Up to this point, it has been established that smart contracts can, in principle, fulfil the requirements for forming contracts.

However, in the absence of a traditional governing contract, if there are mistakes in the code, a court reviewing a smart contract in a dispute faces difficulty in establishing any evidence as to what the parties had agreed upon other than the incorrectly encoded smart contract. Therefore, the incorrect code may be deemed to represent the understanding of the parties. So, in a smart contract dispute, courts may find it difficult to establish the parties’ intention, which can be called a ‘meeting of minds’ between the parties.

It is well established in common law that the ‘meeting of minds’ element is important to contract formation, but, in French law, it is also essential to establish consent through a ‘meeting of minds’ (i.e. the accord de volontes) by identifying an offer by one party to do or not do something, as well as commensurate acceptance.20

The Singapore case of Quoine Pte Ltd v B2C2 Ltd [2020] deals with the two novel questions (a) what should be done when the contracting parties’ algorithm operated as it was meant to in producing the resulting contract, but one party could, nevertheless, be said to have been labouring under a mistaken belief in entering into the contract, and (b) how should the law assess the state of the non-mistaken party in circumstances where no human is involved at the time of the formation of the contract?21

On the first issue, Quoine’s central argument in its defence was that the contracts underlying the disputed trades (i.e., Trading Contracts) were invalidated in common law and in equity under unilateral mistake. Quoine also alleged that the Margin Traders entered into the contracts with B2C2 for buying and selling Bitcoin and Ethereum under the mistaken belief that they were transacting at prices that accurately represented or did not deviate significantly from the true market price, and B2C2 had actual or at least constructive knowledge of such a mistaken belief.

In order for Quoine to succeed in its claim on the first issue, it had to prove that: (a) in relation to unilateral mistake in common law, the relevant mistake must concern a fundamental term of the contract,22 (b) B2C2 must either have actual knowledge (for unilateral mistake in common law) or constructive knowledge (for unilateral mistake in equity) of the mistake, and (c) in relation to unilateral mistake inequity, B2C2 was engaged in some unconscionable conduct in relation to the relevant mistake.

However, the Court of Appeals disagreed with the lower court’s finding that the claimed mistake concerned the terms of the contract. Conscious that the price at which the Trading Contracts were brought by operation of the parties’ respective algorithms and that these had operated exactly as they had been programmed to act, the mistake in this case was a mistaken presumption on the part of the Margin Traders as to how Quoine’s platform would operate (i.e., the platform would not fail). Such a mistake was only a mistake in presumption as to the circumstances under which the Trading Contracts would be concluded, instead of a mistake as to the price at which the Trading Contracts were entered into.

With reference to the issue of knowledge, the majority of the Court of Appeals confirmed that, in the context of a deterministic algorithm,23 it was the programmer’s state of knowledge that was relevant to the parties. The relevant timeframe for assessing the programmer’s knowledge was deemed to be from the point of programming up to the point that the relevant contract was formed. This was supported by the view of amicus curiae Professor Goh Yihan, who recognised that the time of programming is when the programmer’s knowledge is the most concretised.24

Programmers are not expected to be prophets and mistakes can take a wide range of forms. But it is clear that the law on unilateral mistake is concerned with (a) a type or class of mistake, that is one concerning the fundamental terms of the contract (at least in common law), and (b) the mental state of the non-mistaken party — whether they knew (or ought to have known) of the (type of) mistake and were acting to take advantage of it.25

However, “according to a paper published by the Association for Computing Machinery in 2016, coding bugs and other vulnerabilities were identified in nearly half of all smart contracts written on the Ethereum blockchain, potentially putting at risk $30 million worth of the virtual currency Ether. A review of Ethereum smart contracts conducted by Peter Vessenes, the co-founder of the Bitcoin Foundation, revealed at least 100errors per 1,000 lines of code. The high error rate, in part, may be attributed to the fact that writing smart contract code remains highly complex. Researchers at the University of Maryland’s cryptocurrency lab observe that ‘even for very simple smart contracts (e.g., a Rock, Paper, Scissors game), designing and implementing them correctly was highly non-trivial.’”26

These high error rates may result in a surge in disputes relating to smart contracts. Although there are not many case authorities or materials that can be found regarding smart contract disputes, the case of Quoine Pte Ltd v B2C2 Ltd has provided some guidance on how smart contract disputes can potentially be resolved within the framework developed by the Singapore Court of Appeals. “It also enables the court to examine and consider the knowledge actually acquired after the point of programming and the actual conduct of the parties up to the time of the contract.” However, the court emphasised that this is directed at actual conduct. The court also said that “rather, working backwards from the output that emanated from the programs, we are driven to assess the relevant state of knowledge by examining that of the programmers.”27

Challenges surrounding encoded contracts vs natural language contracts

Natural language contracts (i.e., traditional contracts) have generally been the result of a reasonable arrangement between parties with break even with haggling control, i.e., parties arranging at arm’s length (Savelyev, 2017). However, the very viability of smart contracts depends on the ability to express contractual obligations in code. For obvious reasons, natural language cannot be directly executed by a computer, and self-enforcement requires that the terms of the smart contract be computer-readable.

Therefore, there are multiple options: (a) a smart contract can be a translation of an existing agreement, it can be created in code from the outset or, (b) a contract can be drafted in natural language with subsequent encoding in mind. In addition, there are challenges associated with converting natural language into code and, more broadly, with encoding contractual obligations (i.e., ’encoding’ of obligations).

It is important to note two points before moving forward. First, it must be noted that the present discussion would not be relevant if technical writing restricted smart contracts to a very narrow range of relationships, whose performance was easily determinable by fixed formulae, as is the case with current smart contracts (Kiviat, 2015; Schroeder, 2016; Fairfield, 2015). In spite of the increasing recognition that some contracts cannot or should not be smart, many writings continue to extol the power of smart contracts to transform all types of contracts, including employment contracts, leases, and mortgages. As a second point, technical writings offer little guidance regarding how smart contracts should be formed or negotiated. The parties are generally assumed to create their own smart contracts or agree to use ones already created by somebody else.

Although smart contracts can be created as one-off, customized programs, economies of scale require that they be made into generic programs that can be used on a mass scale. These forms can include, for example, popular standard form agreements, such as those used for mortgages, car loans, and interest rate swaps.

In such a case, only certain values would be customizable for each transaction. The important thing to bear in mind is that it is likely that the smart contract will not be encoded by the parties themselves, or that at least one of the parties will not participate in its creation. As a result, either both of the parties or one of them will be unable to verify that the code accurately reflects their consent or how the smart contract works in practice.

That will inevitably lead us to the issue of contract translation. Because smart contract makers (i.e., coders) cannot decide on its business and legal aspects (Frantz & Nowostawski, 2016), it is reasonable to believe that there must be a document describing the substance of the agreement. Therefore, many smart contracts come from documents written in natural language that require further translation into code.

It has to be said that the complexity of this process is generally underemphasized, as technical writings extol consistent progress in the areas of machine learning and natural language processing and assume that the translation of natural language into code can be automated, or at least significantly facilitated by technological means. At the push of a button, agreements could be transformed into executable code, like source code is incorporated into object code. Notwithstanding predictable advancement in said areas, as of now, it is difficult to automate the transformation of natural language into code without a critical trade off in the nature of the yield of such transformation.28

Approximations appear to be admissible in mechanized interpretations of natural language, where the general importance of a sentence can be gathered from unique circumstances. These are nonetheless painful with respect to legal arrangements, which are drafted with fastidious exactness, where one single word may bring about accidental business outcomes and prolonged disputes.29 Besides, accuracy appears to be vital when the smart contract is to self-execute and cannot be halted or revised. In the event that a smart contract is to embody a current arrangement, its interpretation into code will include a monotonous manual process, and developers fail to appreciate the low tolerance for mistakes in legal documents (Katz, 2013).

Additionally, developers appear to see contracts as sets of conditional statements abundant in standard clauses that can be unendingly reutilized for different transactions. While it is true that lawyers often rely on contractual precedents and (sometimes too eagerly) copy-and-paste individual provisions, it must not be forgotten that the standardization of legal language does not imply that such language is capable of reduction into an algorithm. Notwithstanding its formalistic nature, legal text is still natural language, and natural language is innately ambiguous, as the significance of words consistently relies upon context.

Hence, because of its long sentences, clauses, nested expressions, and references to abstract concepts, legal language is more difficult to translate into code than normal natural language. It has generally been suggested that smart contracts need to create a custom domain-specific programming language to capture the nuances of legal text.30

However, the main problem is that translating natural language into code is not the simple process of converting legal prose into computer-readable instructions but requires an interpretation of legal prose in advance. Interpretation is not an academic activity but is used to determine the exact scope of the obligations of both parties, the results to be achieved according to the contract, or the degree of effort required to perform specific obligations.

It is worth mentioning that the successful performance of a contract may depend on the meaning of a word, and disputes over a word may lead to lengthy litigation. There is hardly a contract that does not require some interpretation, thus, the presence of some legal and commercial knowledge on the side of the interpreter is necessary. Hence, in the case of a smart contract, this would have to be performed before, or in parallel with, the process of translating the legal text in code. However, developers can hardly be expected to perform this task.

Interpreting contracts requires in-depth knowledge of the principles governing contractual interpretation (i.e., principles surrounded by multiple controversies relating to the question of how to determine objective meaning of words and expressions, or the meaning that must be deemed to have been intended by both parties). This meaning may depend on other words used in a given contractual document, or more broadly, on the context in which they are used.31 Whoever interprets a contract must be able to decide between the literal and the purposive approach and, in the event of competing interpretations, select the one that is more consistent with business common sense.32

This would mean that the interpreting developer would have to ascertain the meaning that the contract “would convey to a reasonable person having all the knowledge which would reasonably have been available to the parties in the situation in which they were at the time of the contract.”33 Furthermore, it should not be forgotten that the interpretation process is not limited to the case in which words are ambiguous and can sometimes also reveal the existence of ambiguities.34

For contracts in natural language, it may not be immediately evident to the parties that a particular word or expression may have multiple interpretations. However, in the smart contract context, the issue would not lie with the parties disagreeing over the meaning of the words, but in the likelihood that those deciding how to covert a particular obligation into code will make a mistake in interpretation. It should be noted that most contracts contain gaps which require that terms be implied to make the agreement workable in practice. Contractual interpretation is usually performed by courts after a dispute has arisen, and the implication of terms is traditionally determined by courts, and not contracting parties.

If the implication of terms requires an understanding of legal rules, as well as the commercial context of a particular transaction, coders may not be able to identify and fill contractual gaps themselves. For instance, there is no flexibility for parties to incorporate a term that has one meaning at the time of execution but can be interpreted differently during the performance phase. Therefore, what can be done when the meaning of terms needed in a smart contract can vary?

Variation of terms and how it is done?

Although arguments may be presented that the problems surrounding the interpretation of supplementary contractual language may be solved by lawyers and coders collaborating to translate legal documents into executable code, it must be noted that, in spite of such collaboration, neither the parties nor their lawyers will be able to ascertain whether the code in the smart contract correctly reflects the originating legal documents. For example, even if a smart contract mirrors this document, with all its nuances, there is still potential for inconsistencies between what was agreed upon and what was implemented. Such inconsistencies are particularly confusing given that, once a smart contract commences self-enforcement, it cannot be stopped or amended.

It must be said that, at present, there is no simple path to amend a smart contract that would create certain challenges for contracting parties. Amendments or modifications are relatively easy in conventional contracts, and parties can waive provisions if they so choose. However, smart contracts lack flexibility in semantics and enforcement, when compared to conventional contracts. Hypothetically speaking, with a traditional text-based contract, if there was a change in law, the parties could quickly draft an amendment to address that change, or alter their course of conduct. Smart contracts do not currently offer such flexibility. It is worth mentioning that, given that blockchains are immutable, modifying a smart contract is far more complicated than modifying standard software code that does not reside on a blockchain.

Given the current technical and economic uncertainty of this phenomenon, the debate over its legal implications is equally precarious, and defending the idea of disseminating these technologies requires some sort of a leap of faith. On the one hand, true believers in smart contracts and blockchain magnify these tools, their potential, and their capacity to bring the automation of contracts to its limits (Surden, 2012). They promote the use of technologies that can allegedly predict a huge number of variables to provide highly sophisticated solutions.35 On the other hand, there are scholars who are unwilling to endorse this technological miracle. They express doubt about the capacity of smart contracts to embrace all the different facets that characterize traditional contracts and their bargaining processes and, thus, suggest a more cautious approach (Druck, 2018; Levy, 2017).36

There is also a chance that amending a smart contract may produce higher transaction costs, as supposed to amending a text-based contract, and increase the possibility that the parties will not accurately reflect the modifications they intended. Similar challenges also exist with regard to terminating a smart contract, for example, if a party discovers an error in an agreement that gives the counterparty more rights than intended, or concludes that fulfilling its stated obligations will be far more costly than expected. In a text-based contract, a party can engage in, or threaten, so-called ‘efficient breach’ (i.e., knowingly breaching a contract and paying the resulting damages if it determines that the cost of performing is greater than the damages it would owe). By ceasing performance or threatening to take that step, a party may bring the counterparty back to the table to negotiate an amicable resolution. Smart contracts do not yet offer analogous self-help remedies.

Hence, can variation of terms be done before concluding a contract? This consideration has two consequences: on the one hand, it invites scholars to address the divide between unilateral and bilateral contracts and its implication within the realm of smart contracts. On the other hand, and more importantly, it reveals that the traditional narrative that smart contracts can serve as tools to reduce time and transaction costs might be superficial as soon as the creation of a (true) smart contract requires the contribution of a plurality of people. Someone who wants to launch a contractual initiative needs, first and foremost, a software developer (Walch, 2018) to transpose the instructions related to the various aspects of the agreement into virtual architecture, to build a data model (structured according to directives and conditionals) for the offer to operate, while also taking into consideration the different forms of interaction between the counterparties. Hence, it may be said that the possibility of completely eliminating the role of an intermediary is already confuted at its roots.

Moreover, consider also that the developer must also be able to communicate with another operator who is in charge of establishing the conditions for access to the platform where the code will operate (and where the general public, or the counterparty, will be able to find and eventually conclude it). Finally, users acting on the platform must be able to interact with the ‘offer’ if they wish to amend its conditions before concluding the contract, as traditionally happens during negotiations. This requires the presence of other intermediaries on their side as well.37

This would imply that, without the development of mechanisms that allow contracting parties to address a change in circumstances and more easily adjust terms, the utility of stand-alone smart contracts that were intended to have legal effect may be limited, particularly in complex transactions. In these circumstances, the necessary flexibility and management of contract amendments may be provided by augmenting smart contracts with a master agreement, a conventional (natural language) contract, or an overarching participation or governance framework having legally binding effect.

Given the practical impossibility of amending terms in smart contract, as the code is distributed on the blockchain across a network and would require sufficient consensus of the network to alter, the only solution for creating the effect of amending a blockchain smart contract is to deploy and use a new one instead. Therefore, could a Ricardian contract model that links smart contracts to traditional contracts solve the issue of amending contractual terms? As commercial transactions are dynamic, this is left for the parties to decide. The question of whether a smart contract should be linked to a traditional contract will be largely dependent on the complexity of the deal.

Smart contracts can help facilitate safe and transparent transactions, whose records are immutable, while traditional contracts and legal institutions can ensure their validity, provide the required legal framework, and take care of disputes. This means that the Ricardian contract will consist of both a smart contract and a legal contract (i.e., traditional/natural language contract), where the legal contract is supplemented and not replaced. Therefore, to handle complex legal issues, it is possible to suggest that, until there is greater clarity on standalone smart contracts, parties should consider using Ricardian contracts (smart contracts that are governed by or which implement provisions of a traditional contract) with a traditional contract they know a court will enforce.

Encoded Contracts vs Ricardian Contracts vs Traditional Contracts

Having extensively discussed and explored the issues pertaining to encoded contracts vs natural language contracts in the previous sections, we have come to the topic of Ricardian contracts. It is worth reiterating that smart contracts are automated applications that run on blockchain technology, without third-party enforcement or verification. They are designed to result in a particular agreed-upon outcome based on a set of if- then premises that put actions into motion once certain conditions are met. Because the blockchain records information in a manner that can be described as immutable, the execution of smart contracts is often irrevocable, which means that, once a certain action is in motion, it cannot be undone.38 It is also worth mentioning that both smart contracts and Ricardian contracts need to satisfy all of the requirements of a legally binding contract to be enforceable.

Since smart contracts are written in code, it is difficult to determine and enforce the agreement if there is no natural language contract that sets out the terms, especially in circumstances where the code contains an error or carries out an action contrary to the parties’ intentions. Furthermore, it is unclear whether the if-then statements embodied in the computer code will necessarily meet all of the requirements of a contract.

A Ricardian Contract is a legal contract that was first introduced in 1995 by a well-known programmer, Ian Grigg, and this concept is now part of the blockchain. What makes Ricardian contracts unique is that they are cryptographically signed and verified. As opposed to encoded contracts, Ricardian contracts are available in a human-readable text that is easy to understand (not only lawyers), and these legal agreements or documents can be read by both computer programs and humans.

To put it simply, they serve two purposes. Firstly, they are easy-to-read legal contracts between two or more parties that lawyers can easily understand. Secondly, they are machine-readable. Hence, Ricardian contracts can be easily hashed, signed, and saved on the blockchain. On the whole, Ricardian contracts merge legal contracts with blockchain technology and bind the parties by a legal agreement before the execution of the actions on the blockchain network.39

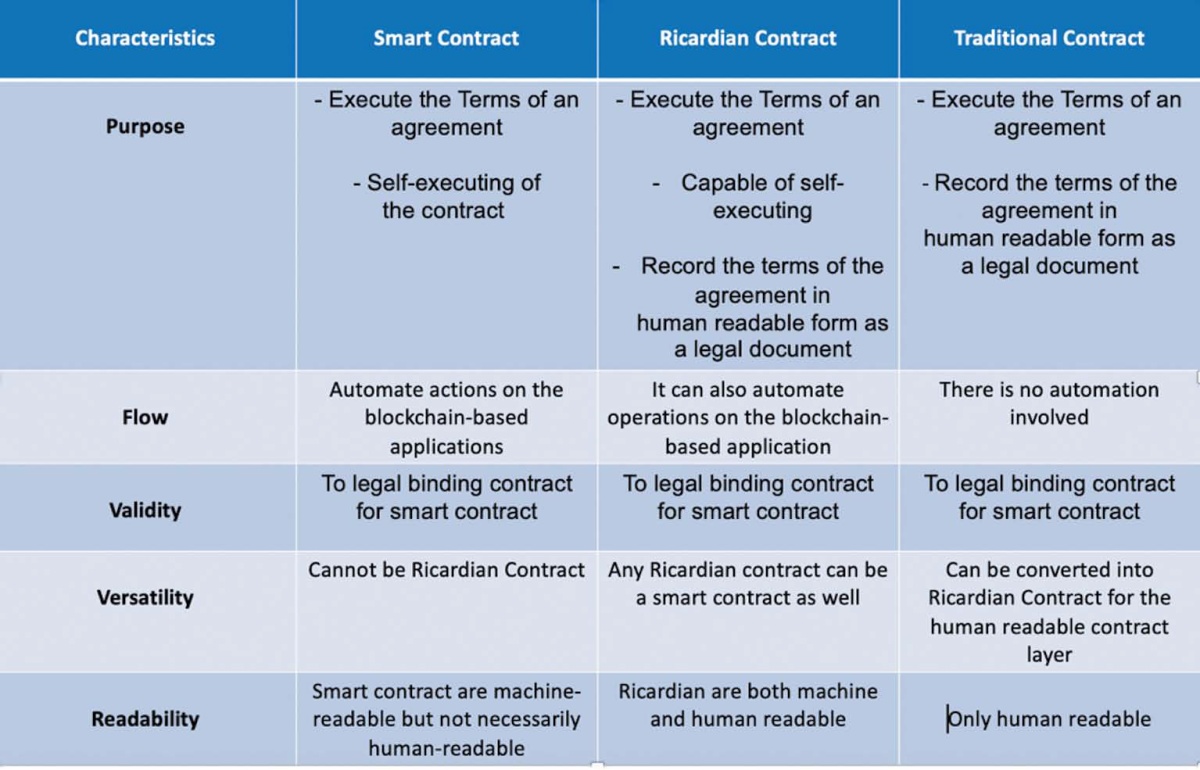

Ricardian contracts set out the intentions, as well as actions that will take place in future based on a legal agreement. The foundational difference between Ricardian contracts and smart contracts on blockchain platforms is the type of agreement. The difference is that Ricardian contracts record an agreement between multiple parties, while smart contracts execute whatever is defined in the agreement as actions. Refer to the table comparing Encoded Contracts vs Ricardian Contracts vs Traditional Contracts below.

So, do Ricardian contracts provide more clarity and certainty with respect to the terms of the contract? These issues may be addressed by Ricardian contracts that link a natural language contract to the underlying code. Since the text clearly specifies the smart contract code with which it is associated, the parties can clearly see the variables that are passed on to the smart contract, as well as how they are defined and how transaction events will trigger the execution of the code.40

The characteristics of Ricardian contract can be summarized as follow41:

- Human parsable; 42

- Printable document;

- Program parsable;

- All versions (i.e., displayed, printed, parsed) are manifestly equivalent;

- Signature of the Issuer;

- All relevant information is present in one single document, including signature and parties. This, along with the manifestly equivalent characteristic above, results into the Rule of One Contract;

- It can be represented as a legal contract;

- It can be identified securely, wherein ‘securely’ means any attempt to distort the linkage between a reference and the contract is not feasible;

- It is supported by financially capable PKI (such as OpenPGP (https://www.openpgp.org/));

- Extensible — it can interpret bonds, shares, loyalty, etc.;

- It can identify the legal issuer (signer of contract) and issuance server;

- Cannot be changed by anyone except a legal issuer or other parties to the contract;

- Verifiable in nature; and

- Permissionless — the contract can be created and used by anyone without requiring allocations in controlled spaces.43

It is worth highlighting some other benefits of Ricardian contracts. First of all, they are secure in nature, as they use hidden signatures, and the signing of contracts takes place through private keys. Later, the hash of the agreement is used to attach that hidden signature to the contract. Ricardian contracts also offer protection to parties in an agreement who do not have equal bargaining power from parties in a stronger position that may be more likely to unilaterally change the terms of the agreement during execution. Hence, once the agreement is finalized, it cannot be unilaterally modified, making it very secure. Furthermore, when the signature of the issuer is added to the contract, it creates a legible and binding agreement with respect to the information described in the document. This also makes it possible to track the parties involved with the help of a private key and hold them accountable.44 Therefore, it has been suggested that Ricardian contracts may be the best way to bridge the gap between law and technology today.

Figure 1

Overview of How Ricardian Contracts Work42

Note. Created by author.

Figure 2

Comparison Table: Smart Contracts vs Ricardian Contracts vs Traditional Contracts

Note. Created by author.

IS CRYPTOCURRENCY PROPERTY?

United States

At the outset, it must be said that this discussion on whether cryptocurrency can be considered property, and its regulatory treatment in various jurisdictions, is based on the positions that the jurisdictions have adopted at the time of this paper was written.

If smart contracts, in principle, are capable of fulfilling the requirements for the formation of contracts, then the natural question that follows would be, “Can virtual assets be seen as property?” However, in order to answer this pressing and controversial question, it is necessary to explore and examine the approach to crypto assets in property law, as well as its regulatory status.

In recent years, it has been noticed that most jurisdictions (like US, UK, Australia, Singapore, and Hong Kong) have begun to edge their way towards formally recognizing this new category of property, despite the fact that crypto assets do not generally fall within the traditional criteria for property — with the exception of tax authorities, which moved in this direction early in order to protect the tax base.

As crypto assets become more important in the economy, more governments around the world have realized that crypto assets are property. This recognition has been based on a gradual expansion of related principles and a lot of pragmatism. The classification of crypto assets into value/asset, payment, or utility tokens has been widely adopted and follows the regulatory consequences. However, the difference lies in how each regulator analyses a token taking into account the terms of their country’s securities and payment laws.

For example, in the United States, cryptocurrencies are subject to different and sometimes overlapping legal and regulatory systems. These systems may include currency, securities, commodities, or general intangibles, as it depends on the specific circumstances considered by the investigation. Although it is not yet an established law, cryptocurrency is considered personal property in various situations. The US Supreme Court has well established that property rights are a creature of state law. Property rights are not empowered by the federal constitution, rather, “individual entitlement [to property] is grounded in state law.”45

However, at a statutory level, the State of Wyoming recently enacted a law that came into effect on July 1, 2019, which explicitly recognizes digital assets (including cryptocurrency) as intangible personal property.46 In most states, it remains arguable whether cryptocurrencies meet the criteria established by the courts for the recognition of a property interest. In reference to a dispute over property rights concerning Supplemental Type Certificates issued by the Federal Aviation Administration, the Ninth Circuit Court of Appeals identified three criteria under California law: (i) an interest capable of precise definition; (ii) capable of exclusive possession or control; and (iii) where the claimant has established a legitimate claim to exclusivity.47

Therefore, the regulatory perimeter can be found in IRS Notice 2014-21, 2014-16 IRB 938 (14 April 2014), where the Internal Revenue Service ruled that, for federal tax purposes, cryptocurrencies are treated as property.48 Some other agencies also place cryptocurrencies in the ‘digital assets’ category. For example, on November 16, 2018, the US Securities and Exchange Commission (SEC) issued a Statement on Digital Asset Securities Issuance and Trading, and, on April 3, 2019, issued a Framework for Investment Contract Analysis of Digital Assets. Both directions from the SEC use the term “digital assets” when referring to cryptocurrencies.

United Kingdom

The status of cryptocurrencies, distributed ledger technology (DLT), and smart contracts is still unclear under both English private and financial regulation. Under English law, personal property is either a ‘chose in possession’ or a ‘chose in action’. For example, English law does not expressly treat intangible Bitcoins based on DLT as either. Furthermore, data or information is not considered property in itself, nor do Bitcoins create contractual rights against anyone, though it is said by HM Revenue & Customs that crypto assets are property for the purpose of inheritance tax.

However, it is worth noting that in the July 2019 case of Robertson v Persons (unreported, CL-2019-000444) the London Commercial Court indirectly ‘recognized’ Bitcoin as legal property for a time. This is because the court is preparing a temporary asset preservation order to prevent stolen Bitcoins from disappearing or being transferring in cases of hacking, when email accounts are attacked by spear phishing. The attackers transferred most of the Bitcoins to a digital wallet leading back to the UK subsidiary of a well-known digital currency exchange. Some have argued that the ‘theft’ of Bitcoin did not transfer ownership to the hackers, so ownership cannot be transferred to exchanges. However, the judge recognized and accepted that this was a question to be tried.

Interestingly, the claimant relied on a decision by Simon Thorley IJ in the Singapore International Commercial Court case of B2C2 Ltd v Quoine Pte Ltd [2019] SGHC(I) 03, where Bitcoin was held to be personal property that can be the subject of a trust. In addition, an English High Court decision in Armstrong DLW GmbH v Winnington Networks Ltd [2012] EWHC 10 (Ch)49 was referred to, which concerned the fraudulent transfer of carbon emissions allowances, where the court upheld the claimant’s claim for the value of the allowances on the basis that they constituted a form of intangible property.

While there is still uncertainty over crypto assets and smart contracts in the UK, the regulatory treatment by the Financial Conduct Authority (FCA) suggests that their categorization depends on their intrinsic structure, as well as their purpose. Security tokens that grant ownership rights, refund specific amounts, or share future earnings are considered “specific investments” under the UK Regulatory Activities Order and possible “transferable securities” under the EU Market in Financial Instruments Directive. Such crypto assets fall within the scope of financial supervision and are therefore also within the scope of the FCA’s powers, as well as investment products, such as derivative contracts that reference these crypto assets. The FCA proposes that retail sales of these be banned. Other tokens that meet the definition of e-money under the Electronic Money Regulations are also fall within regulation.

But it is worth noting that redeemable utility tokens for specific products or services, which are usually provided using DLT platforms, would fall outside of regulation. That would mean that cryptocurrencies, crypto-coins, or payment tokens such as Bitcoin and Litecoin could potentially fall outside of regulation. In comparison, stable-coin cryptocurrencies that are linked to fiat currencies would possibly constitute e-money. At the very least, the FCA published guidance has the merit of setting out its approach to the regulatory treatment of crypto assets. At the very least, as of now, crypto assets would be brought within the AML/CTF regime in accordance with the recommendations of the Financial Action Task Force when the UK passes the EU’s Fifth Money Laundering Directive into national law.

Australia

Although commentators have noted that, in considering Australia’s general law and economic test for property, it is likely that crypto assets like Bitcoin would amount to property. However, to date, there has been little guidance as to whether a crypto asset would be recognized as property under Australian law. Property is usually considered in the context of “rights to identifiable things.” In practice, when something does not meet the accepted indicia for property, the definition does not standstill and the indicia adapts so that the “thing” is not improperly excluded.

Looking through the lens of regulatory treatment of crypto assets in Australia, the Australian Treasury launched a public consultation on initial coin offerings (ICOs) in February of 2019 and called upon industry stakeholders to make submissions. The issues paper published in conjunction with the consultation considers Australia’s current regulatory framework for crypto assets and asks if further regulatory action is needed to address the risks posed by ICOs and promote the smooth functioning of the Australian ICO market.

In 2019, both the Australian Securities and Investments Commission’s (ASIC) information sheet on ICOs and crypto assets (INFO 225) was revised. This provides guidance on how the Corporations Act 2001 may apply to crypto assets. Under the said Corporations Act 2001, persons dealing in financial products must hold an Australian financial services licence. Importantly, ASIC noted that each crypto asset will be evaluated individually based on the specific rights and characteristics of the crypto asset.

While there have been legislative amendments to accommodate the use of cryptocurrencies, these have principally focused on transactional relationships (for example, the issuing and exchanging process) and activities involving cryptocurrencies rather than the cryptocurrencies themselves.

The four most common characterizations of crypto assets are as follow, and each requires the person dealing in these crypto assets to hold a licence and comply with ongoing obligations:50

- Interests in a managed investment scheme (MIS) have three elements: (i) the contributions of money or assets to obtain an interest in benefits produced by the scheme; (ii) those which are pooled or used in a common enterprise to produce financial benefits (or interests in property) for those who hold interests in the scheme (e.g., using the contributor’s funds to build the platform); and (iii) that the contributors do not have day-to-day control over the operation of the scheme. In certain cases, an ICO might constitute a MIS and a crypto asset, therefore it could be an interest in an MIS.

- Securities: Under section 92 of the Corporations Act, securities include shares, debentures or units of shares. A crypto asset may constitute a share where the rights attaching are similar to those usually attached to a share. For example, where there is a right for the owner of the crypto asset to participate in the profits of the company, then the crypto asset may be a share.

- Derivatives: A crypto asset may be characterized as a derivative, where the value of the cryptocurrency is ultimately determined, derived from, or varies by reference to the value or amount of an external reference (e.g., an asset, rate, index or commodity). Asset-backed tokens that are backed by real world assets, such as oil, may in this way constitute a derivative.

- Non-cash payment facilities: A crypto asset may constitute a non-cash payment (NCP) facility under section 763D of the Corporations Act. A cryptocurrency would be an NCP where a person makes payments, or causes payments to be made, other than by physical delivery of cash. It is likely that several utility tokens used for the payment for goods and services would fall to be regulated as NCP facilities under Australian financial services law.

Singapore

There have been discussions in Singapore regarding the legal characteristics of Bitcoin and other crypto assets for the past five years. Yet is remains a difficult and debatable issue, which is complicated by the lack of a uniform definition for ‘crypto assets’ that can be applied to a broad class of instruments with different functionalities. However, there are developments worth noting that may provide some clarity in this space.

As discussed above, the decision on the very first Singapore case of B2C2 Ltd v Quoine Pte Ltd (B2C2) was referred to by the English Courts. Although this point is not technically disputed between the parties, this case is the first judicial reference to use the cryptocurrency as property. Although the decision referred to cryptocurrencies in general, there is increasing recognition that the nature and application of both Bitcoin and Ether differs from security tokens or utility tokens. Correspondingly, such cryptocurrencies would warrant different regulatory treatment.

Legally, Singapore offers a neutral regime for the growth of transactions involving cryptocurrency. Singapore law is commonly used as the governing law in cryptocurrency related contracts because of its advanced dispute resolution laws and its reputation for being an arbitral friendly and neutral regime.51 The Payment Services Act (PSA) came into effect in January of 2020 to regulate traditional as well as cryptocurrency payments and exchanges. The intention behind introducing the PSA was to streamline payment services under a single piece of legislation and calibrate regulations according to the risks such activities pose by adopting a modular regulatory regime (Ho & Law, 2021). The PSA provides a framework to obtain a license to operate a cryptocurrency business in Singapore and outlines money laundering compliances to be met by cryptocurrency operators. The relevant provisions can be found as follows:

(1) Digital payments token: The PSA uses the term “digital payments token” to refer to virtual currencies and defines it as any digital representation of value that:

a. is expressed as a unit;

b. is not denominated in any currency, and is not pegged by its issuer to any currency;

c. is, or is intended to be, a medium of exchange accepted by the public, or a section of the public, as payment for goods or services or for the discharge of a debt;

d. can be transferred, stored or traded electronically; and

e. satisfies such other characteristics as MAS may prescribe.52

Digital Payments Tokens (DPT) recognized by MAS include Bitcoin and Ether. The PSA further recognizes a digital payment token service as dealing in digital payment tokens and facilitating the exchange of digital payment tokens.53

(2) License: Any person carrying out a digital payment token service must obtain a payment institution license, unless exemptions apply.54 A standard payment institution license applies to companies with payment transactions up to $3 million per month and a major payment institution license must be obtained by companies with payment transactions which exceed $3 million per month. An application for both these licenses must be made by a company incorporated in Singapore or overseas, has its permanent place of business or registered office in Singapore; and has at least one executive director who is a Singapore citizen or a permanent resident or is a person belonging to a class of persons prescribed by the MAS.55

(3) Anti-money laundering (AML)/Countering the financing of terrorism (CFT): MAS has released a separate notice on AML/CFT guidelines for DPT service providers. As per the notice, DPT service providers are required to set up robust controls to detect and prefect money laundering and terrorism financing.56 All DPT payment service providers must implement certain measures as a part of their internal AML/CFT policy, which includes:

a. customer due diligence by verifying their identities and businesses;

b. monitoring customer transactions for signs of money laundering and terrorism financing;

c. screening customers by comparing them against relevant UN international sanctions lists; and

d. maintaining detailed records of customer activities and putting in place a process to report suspicious transactions to MAS.57

Generally, persons dealing in crypto assets should be mindful of the implications of:

- the Commodity Trading Act (CTA);

- the Securities and Futures Act (SFA); and

- the Payment Services Act (PSA).

Among other classifications, a crypto asset may be:

- a commodity under the CTA;

- a capital markets product under the SFA; or

- a digital payment token (DPT) under the PSA.

A crypto asset, which is a digital representation of value that is expressed as a unit not denominated in or pegged to any currency and intended to be a medium of exchange, is likely to fall within the definition of a DPT. For example, this includes Bitcoin and Ethereum. Therefore, any business in Singapore that deals in DPTs or offers any service facilitating the exchange of DPTs is considered to perform a digital payment token service, which is a regulated activity under the PSA regime.

The regulator has not defined virtual currency (used interchangeably with ‘cryptocurrency’ or ‘token’ or ‘coin’, unless otherwise specified) to be one exclusive thing, but instead has stated the following:

(a) they are not a currency or legal tender issued by any government;

(b) they are to be encouraged as a means of paying for goods or services to someone who is willing to accept them as a mode of payment, and are a means of making payments;

(c) they cannot be a store of value, as their prices fluctuate (in this regard, the government attitude is not to encourage people to use them as an investment tool, as they are risky);

(d) they are recognised as assets and personal property, with more and more people trading in them.

Switzerland

There is an ongoing discussion about the legal status of crypto assets under Swiss private law. Possible classifications include movable property, energy rights recognized by civil law, a form of intellectual property or data ownership, non-certified securities, and other special private law rights. However, it can be said that one of the most important issues is how to transfer specific rights related to tokens. In either case, the answer varies depending on the economic function and rights of a particular token.

For example, in other jurisdictions, like the UK, as discussed above, although the language varies, a distinction exists between three token categories as follows:

- Payment tokens: These are synonymous with cryptocurrencies and are intended as a means of payment for goods or services, or as a means of value transfer, and do not give rise to claims against their issuer.

- Utility tokens: These provide access to an application or service by means of a blockchain-based infrastructure.

- Asset tokens: These represent assets, such as a debt or equity claim against their issuer. Asset tokens contain a promise, such as a share in future earnings of a company or a project. In terms of their economic function, they are analogous to equities, bonds, or derivatives. Tokens that enable the trading of physical assets on the blockchain (tokenized assets) also fall into this category.

Since these categories are not mutually exclusive, there can also be hybrid tokens. For example, assets and utility tokens can also constitute payment tokens, depending on additional rights. Payment tokens usually do not come with third-party rights. For example, Bitcoin is a pure digital asset. Therefore, according to Swiss law, they can be transferred without written procedures. Although the rules of property law will determine the type of action required to recover illegally disposed assets from the previous owner, in many cases, due to the transnational context of most cases and the universality and purpose of blockchain, this will essentially turn out to be a theoretical transaction.

Different private law rules may apply to public service tokens, which are essentially service vouchers and asset tokens that usually represent promissory notes to third parties. These tokens usually do not represent digital assets but identify the owners of rights against natural or legal persons. This gives rise to the issue of transferability and the question of whether they constitute non-certified securities that can only be transferred in writing. Although it is theoretically possible to use digital signatures to transfer rights under Swiss law, it is currently not possible to do so. The Swiss Federal Council has discussed this issue in a recent consultation on amendments to the Debt Act. According to their proposal, the transfer of rights registered in the registry based on distributed ledger technology will no longer need to be done in writing. If such a change is enacted, it will increase the legal certainty of token transfers. However, it is unclear when or if this amendment will be advanced.

There are currently no DLT-specific laws in force in Switzerland, and comprehensive regulation of tokens or DLT is not contemplated. Rather, the traditional, principle-oriented and technology-neutral approach of Swiss financial market regulation applies. There is a generally published guidance on the regulatory treatment of tokens under Swiss law from the Swiss Financial Market Supervisory Authority (FINMA) — ICO Guidelines. Specifically, FINMA reviews the economic nature of a token to determine its regulatory treatment. For example, whether to treat it as a security. For this, it employs the ‘duck test’: if it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

FINMA follows the categorization of crypto assets as payment tokens, utility tokens and asset tokens (as well as hybrid tokens). The regulatory consequences are highly dependent on specific ‘token economics’and the rights attached to tokens. However, some general statements are possible to make as follows:

- Payment tokens are not subject to prudential regulations if they are pure digital assets. They may, however, be within the scope of prudential regulation if they convey rights to underlying assets (such as units of gold or any other asset or basket of assets that is relatively ‘stable’) to token holders, for instance, in the case of certain stable coins. Issuers and traders of payment tokens must comply with Swiss anti-money-laundering laws.

- Utility tokens are not generally within the scope of financial market laws. However, if a utility token also has an investment purpose at the point of issue, FINMA will treat such tokens as securities.

- Asset tokens may qualify as securities, with consequences for both the primary market (i.e., the obligation to publish a prospectus) and the secondary market (e.g., to trade only on licensed securities trading venues, make follow-up disclosures, etc.). They may also fall within the Banking Act, the Collective Investment Schemes Act, and other relevant laws. Therefore, particular attention must be paid when there is an investment component related to an asset, or if the tokens are in some way linked to an underlying asset.

Switzerland is one of the most crypto-friendly jurisdictions. Swiss law does not consider cryptocurrencies legal tender or, consequently, ‘money’, and does not define the term ‘cryptocurrency’ or ‘virtual currency’. For individuals, cryptocurrencies are seen as assets and are subject to wealth tax, while capital gains on these assets are exempt from income tax. In 2017, the canton of Zug (also known as the Crypto Valley) began accepting Bitcoin and Ether as payment for operating expenses, and Chiasso, in the canton of Ticino, began accepting Bitcoin for tax payments in 2018, with Zug set to follow in 2021.

Therefore, the country’s tax collection authority, the Swiss Federal Tax Administration (SFTA) regards Bitcoin and Ethereum as ‘assets’, which are therefore covered by Switzerland’s Wealth Tax and must be declared on yearly returns. The source of funds from cryptocurrency wealth will also need to be listed on tax returns.

Hongkong

There is currently little guidance or judicial consideration as to whether crypto assets will be recognized as ‘property’ in the law of Hong Kong. The current state of affairs on the treatment of crypto assets as property, the ownership of crypto assets, and their transfer between private individuals is not subject to any legal restrictions or regulations, on condition that they are obtained and/or transferred in good faith. According to their characteristics, crypto assets are sometimes called virtual commodities, cryptocurrencies, digital tokens, or utility tokens, but these are not clearly defined in the law.

The term ‘virtual assets’ was adopted by Hong Kong’s Securities and Futures Commission (SFC) to represent this broad class of instruments, stating that “the polymorphous and evolving features of virtual assets mean that they may be, or claim to be, a means of payment, may confer a right to present or future earnings or enable a token holder to access a product or service, or a combination of any of these functions.”